| Sensex PE multiple leads GDP growth |

| It has been a big indicator in the past of a turnaround in economic activity |

Shishir Asthana / Mumbai Dec 01, 2012, 00:14 IST The market was expecting a poor GDP number for the September quarter, which was delivered by the government. In Q2, the economy grew at 5.3 per cent, a tad lower than the 5.4 per cent expected by economists. The market was expecting a poor GDP number for the September quarter, which was delivered by the government. In Q2, the economy grew at 5.3 per cent, a tad lower than the 5.4 per cent expected by economists.

A sharp swing in mining and quarrying activity gave some respectability to the numbers. This sector had declined by 5.4 per cent in the September 2011 quarter, and as a result of this low base, the growth stood at 1.9 per cent last quarter. Manufacturing continued to remain depressed, posting a growth of 0.8 per cent as compared to 2.9 per cent a year ago. However, manufacturing did slightly better than the 0.2 per cent growth recorded in the June 2012 quarter.While the industry and the finance minister were disappointed when the Reserve Bank of India didn’t cut interest rates in October to boost growth, other data coming from the government suggests the central bank might not be in a hurry to do so. Department of Agriculture and Cooperation data reveals production of rice, coarse cereals, pulses and oilseeds are expected to decline by 6.5 per cent, 18.4 per cent, 14.5 per cent and 9.6 per cent, respectively. Thus, food inflation is likely to remain sticky, at least till the rabi season harvest at the end of FY13.

For the first half, the GDP grew 5.4 per cent. RBI has revised this year’s GDP growth forecast to 5.8 per cent, suggesting the economy will need to grow at 6.2 per cent for the second half, which seems difficult. Thus, it is likely that RBI might reduce its GDP forecast further. However, the stock market did not share the gloom of GDP growth being near a decade low. Key indices are close to their two-year high levels and within 10 per cent of touching a new all-time high. While the markets appear to be running ahead of fundamentals, a comparison of GDP growth with the price to earnings (P/E) ratio of the BSE Sensex depicts a different picture.

As the chart shows, markets are a lead indicator of the economy. In the past, GDP growth has shot up nearly a quarter after the market has risen. In the present scenario too, there is a small diversion between P/E and GDP, indicating the possibility of higher growth rate going forward. One data that points towards such a possibility is the positive growth in gross fixed capital formation which has increased by four per cent, indicating some revival in the asset creation.

http://www.businessstandard.com/india/news/sensex-pe-multiple-leads-gdp-growth-/494190/ |

New Delhi: The year was 1995. On the first day of his job in the Indian Revenue Service (IRS), Arvind Kejriwal received some unsolicited advice from a senior official that perhaps shaped the course of his life from a civil servant to a social activist and a politician who is now the scourge of the political establishment.

“That man told me how to make money in the beginning (of one’s career) and then pretend to be an honest officer for rest of the life,” Kejriwal recalls. “I was shocked and taken aback.”He was 27 years old. In the 17 years since, Kejriwal has, to use a cliche, come a long way. He has carved out a place for himself as a maverick warrior against corruption. The audacity with which he has taken on powerful people—from Sonia Gandhi’s son-in-law Robert Vadra and India’s biggest builder DLFLtd, to Bharatiya Janata Party (BJP) president Nitin Gadkari and Reliance Industries Ltd chairmanMukesh Ambani—has won him a following, although the jury is still out on whether this will pay an electoral dividend.

His opponents dismiss him as a publicity hound in a hurry to carve out his own political space by taking on the ruling Congress as well as the principal opposition BJP.At the last count, Kejriwal had 169,000 followers on Twitter and, by his own admission, has become quite a public personality—a fact with which he is yet to come to terms.From the speed at which he operates—he has moved from one target to another in his fight against public malfeasance under the banner of the India Against Corruption forum ahead of the launch of his Aam Aadmi Party on Monday—Kejriwal has appeared to be in a race against time. He accuses politicians of selling out the country.“Yes, we are in a hurry,” he said. “The way this country is being sold, it will not be saved. Coal, iron, thorium, land have been sold, jungles are sold out, mountains are being sold in Himachal Pradesh and rivers in Chhattisgarh; what is left now? In some time, they will sell the Taj Mahal, Lal Qila and Rashtrapati Bhavan,” Kejriwal says.

On Monday, the Aam Aadmi Party started a membership drive and introduced the 23 members of its national executive, which includes lawyer Prashant Bhushan, Right to Information (RTI) activist Manish Sisodia and former television journalist Shazia Ilmi. Kejriwal is the national convenor.Kejriwal’s political ambitions led to the parting of ways with Anna Hazare, who initially spearheaded the nationwide agitation for an independent anti-corruption ombudsman called the Lokpal. He was accused by critics of using Hazare to promote his political goals by joining the campaign for a Jan Lokpal Bill that fell flat in Parliament. Kejriwal denies the charges.“Anna is not a toy to be used,” he said. “No one in this country uses anyone. We are not in selfish politics, we are here for the country.”

Kejiwal says he himself had been “personally hostile to the idea” of turning political and that the decision to launch a political forum was made only after six-seven months of brainstorming within his team.Kejriwal was born in a small-town family in Haryana on 16 August 1968. His father Govind, an engineer like him, worked in several companies before settling down to a job in a Hissar-based steel firm. His mother Gita completed high school. Kejriwal has a sister and a brother, both younger than him.

Like any other student

After studying in schools run by missionaries, he cracked the examination for admission to the Indian Institute of Technology (IIT) on his first attempt and joined the mechanical engineering stream at IIT-Kharagpur in 1985.Rajiv Saraf, his IIT batch-mate, remembers Kejriwal as a student like any other who gave no one an inkling that he had activist and political leanings. “For us, it just came out of the blue; we had never expected this,” said Saraf, who runs a software company.“We never discussed corruption in the campus because it was not of that big a scale or at least was not discussed in the newspapers,” Saraf said. “The only paper we used to get was The Telegraph because of our proximity to Kolkata. Arvind was just like (any) another student and he gave preference to dramatics over academics. He would go out and drink or play cards with us.”Saraf is Kejriwal’s best friend from his college days and one of the people who helped him raise loans to reimburse the government for his voluntary retirement from the civil service after he had taken two years’ paid study leave.

Kejriwal has several friends, many of them in the US, who all contribute and give him Rs.25,000 every month for a living so that he can continue his fight against corruption.“Rest of the expense is borne by my wife, who is an additional commissioner in income-tax department. I have no other source of income and I do not take any money from Indian Against Corruption,” Kejriwal said. He and his wife Sunita have two children—daughter Harshita and son Pulkit.After graduating from IIT, many of his friends left for the US, but Kejriwal stayed back. He took up a job with Tata Steel Ltd and was posted at the company’s Jamshedpur design plant in 1989.Poosarla Srinivas, who worked with Kejriwal, recalls him as a humble and approachable person. “After office hours, we used to hang out together. He would share his conviction do something for the underprivileged. After he quit his job at Tata, he went to (meet) Mother Teresa and saw the plight of the poor and sick,” Srinivas said. After some time, Kejriwal returned to his job at Tata Steel. He also appeared for the civil service examination, and made an unsuccessful attempt to get into a top management college. He cleared the civil service exams and was posted in the Indian Revenue Service. His first posting was in Delhi as an assistant tax commissioner.

Harsh Mander, a civil servant-turned-social activist and Kejriwal’s instructor at the Lal Bahadur Shastri National Academy of Administration in Mussourie, remembers him. “He was different from others and would always talk about corruption. I always felt that he had energy and wanted to do something about it,” said Mander.

RTI activism

Kejriwal worked in the tax department for some time, but his heart was never in the nine-to-five routine. In 1999, he took a sabbatical to work with Parivartan, a non-government organization.In the same year, on the advice of Mander, Kejriwal met Shekhar Singh, a person who would later join him in a movement that would give India landmark legislation in the form of the RTI Act.Singh, a working committee member of the New Delhi-based National Campaign for People’s Right to Information (NCPRI) and an RTI activist, has known Kejriwal for 12 years. Apart from Kejriwal, Mander and Singh, other working committee members of NCPRI include Kejriwal’s close aide and Supreme Court lawyer Prashant Bhushan.“Arvind is a very competent person and there is no reason why, if other people can start a political party, then he can’t? But the only challenge is whether his party will be fundamentally different from other political parties,” Singh said.

While there are a large number of social activists across the country, Kejriwal belongs to a small subset that has taken on political issues and won public attention. What separates Kejriwal from other social activists is the fact that while the others focus on two or three issues, Kejriwal has the big picture in mind, according to his associate Abhinandan Sekhri.Having taken up RTI as a cause, Kejriwal co-founded the Public Cause Research Foundation, which espoused transparent and accountable governance, in 2006 along with two other people—his long-time aide and former television journalist Manish Sisodia and television producer Sekhri.According to Sekhri, who has known him for almost 10 years, Kejriwal is the “ideal person” to lead a movement like the one against corruption given his focus and steadfastness.“People often criticize Arvind because he does not compromise. But, today we need someone like him, who will not compromise against a system that asks you to compromise at each and every stage,” said Sekhri, who is also the co-founder of “Newslaundry”, a current affairs and media website.

Not everybody agrees.

“Arvind has a set of views on how things should change and he would brook no opposition to it. He refutes everything with a belief that only what he says is correct,” an RTI activist who has known Kejriwal for almost nine years said, requesting anonymity.According to this person, Kejriwal had at one point dismissed RTI work as a “waste of time” given that information commissions were not performing and government functioning was too opaque.“By that time, he was totally disillusioned with the RTI Act,” he said. “He does not want to hear or listen, but he still wants to consult. Beyond a point, people lost faith in him as there is no point in only signing attendance registers.”For his work on RTI, Kejriwal won the prestigious Ramon Magsaysay Award for emergent leadership in 2006.

The politician Kejriwal

Kejriwal says he has jumped into the mire of politics with the intention of cleansing it by taking a top-down approach.From an activist to a full-fledged politician, he has had a rollercoaster journey, and he is still fighting for political credibility. He claims, however, that he is now stronger and more mature. “I think now I have the patience and ability to tolerate more,” Kejriwal said.Kejriwal’s idea of governance and the basic ideology of his Aam Admi Party is based on the principle of “Swaraj”, or total decentralization of power. He released a book of the same name earlier this year. India Against Corruption would be the “watchdog” of his party, he added.Kejriwal and his team members are also aligning with several smaller anti-graft movements, rights movements, organizations and smaller political parties. Even before the launch of the party, district-level teams were already in place in Orissa, Uttar Pradesh, Rajasthan, Punjab and Haryana. According to Singh, Kejriwal has it in him to take the Aam Aadmi Party forward.

“One of the major reasons why Arvind can be successful is that he is a very effective speaker, a fantastic organizer, which we all have seen in the past, and has a fairly high level of commitment and interest in the issues that he has taken up,” he said.The RTI activist cited above doesn’t think Kejirwal will be different from “other political leaders”, most of whom do not believe in a democratic system. “He is a leader with strong non-democratic traits; he is in a way choosing the conventional method of leading people, doing politics,” he said.

http://www.livemint.com/Politics/XERu7Qq6eidzuQrpQewQcN/The-different-shades-of-Arvind-Kejriwal.html

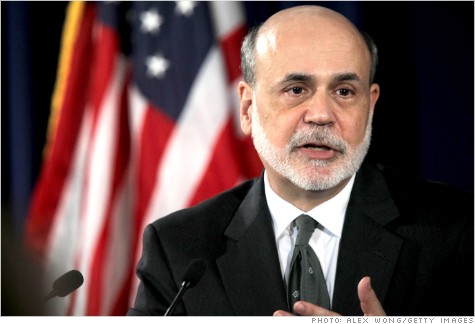

NEW YORK (CNNMoney) -- Federal Reserve Chairman Ben Bernanke on Tuesday urged lawmakers to act as soon as possible to avoid the fiscal cliff. "Coming together to find fiscal solutions will not be easy, but the stakes are high," Bernanke said, speaking before the Economic Club of New York.The Fed chief cited projections from the

NEW YORK (CNNMoney) -- Federal Reserve Chairman Ben Bernanke on Tuesday urged lawmakers to act as soon as possible to avoid the fiscal cliff. "Coming together to find fiscal solutions will not be easy, but the stakes are high," Bernanke said, speaking before the Economic Club of New York.The Fed chief cited projections from the