I AGREE WITH THE AUTHOR...I AM HAVING SAME VIEW IN INDIAN MARKETS????......

Is Wall Street manipulating this rally?

As traders push stocks slowly higher, blissfully ignoring all that's still wrong with the global economy, there's evidence that something is amiss.

By Anthony Mirhaydari on Fri, Jan 20, 2012 12:56 PM

Stocks inched up Thursday for the 10th day out of 12 trading sessions in 2012, pushing various technical indicators deeper into oversold territory and reaching levels not seen in many cases since late last April, when stocks were putting in their bull market high. Volume and breadth were pathetic. Up volume accounted for only 65% of total volume on the NYSE.

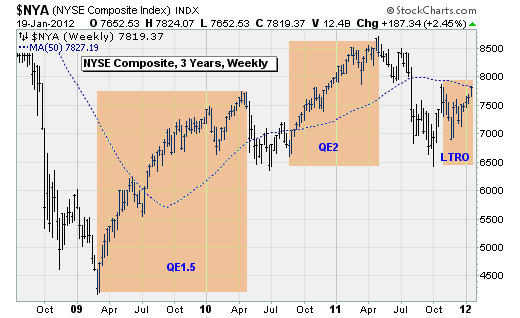

All that matters, apparently, is that the European Central Bank dumped just over €200 billion in three-year money into the system a few weeks into a long-term refinancing operation to supply capital to banks. While not exactly like the quantitative easing done by the Federal Reserve a few times, this LTRO looks, smells and tastes just like the Fed's QE1 and QE2 to the Wall Street fat cats worried about their bonuses.

And they're using every trick in the book to juice the market higher. But here's the thing: Regular investors aren't buying what Wall Street is selling.

Just look at Thursday's action.

Investors ignored a batch of mostly bad news. There was a disappointing Philly Fed manufacturing report. Greece continued its efforts to negotiate a voluntary debt reduction with its bondholders, many of whom, as you know, are hedge funds that have undertaken a "basis trade" using credit default swaps and are poised to cash out no matter what happens (and therefore have an interest in holding out for the absolute best possible deal).

And there was some disappointing earnings news, too, in what is shaping up to be the worst earnings season (based on positive earnings surprises) since 2001, according to Sundial Capital Research.

In response, Wall Streeters are buying now, asking questions later, and are beginning to foam at the mouth as they push their bets to try to encourage a buying frenzy. This, in turn, is pushing sentiment measures based on things like options trading, analyst sentiment or the relative volume in the Nasdaq vs. the NYSE to extremes.

Boy, are they pushing. TrimTabs compiled a list of data points showing the extreme optimism on Wall Street:

- Short interest at New York Stock Exchange members plunged 10.5% in December to the second-lowest level of the past two years.

- Options traders are growing more complacent. The put-call ratio averaged just 0.81 on the past five trading days, the lowest five-day average since July 2011.

- The VIX fell to 20.5 on Jan. 12, the lowest level since July 2011.

- Of the hedge funds TrimTabs surveyed in cooperation with BarclayHedge in December, 42% were bullish on the S&P 500, while 30% were bearish. That level of optimism was the highest since July 2011.

- Investors Intelligence reports that 51.1% of newsletter writers are bullish, the highest level of optimism since April 2011, when the U.S. stock market topped out.

- Bank of America's survey of global fund managers found that asset allocators are more bullish on U.S. stocks than at any time since April 2010.

Despite all this, average investors are staying on the sidelines. TrimTabs estimates that U.S. equity funds have received only $3.3 billion in new cash so far this month, which is historically a very heavy month for inflows. Compare that with the $932 billion that flowed into checking and savings accounts, eight times the $117 billion that went into stocks and bond funds as well as ETFs.

Thus the low-volume, narrow-breadth, low-volatility grind higher we've witnessed so far this month. But here's the thing. The half-life of extraordinary monetary policy efforts is falling fast. Very fast.

It lasted for a year starting in March 2009 -- that was QE 1.5, when efforts announced in November 2008 were expanded -- thanks to the tailwinds from the market discounting the end of the recession and the end of the financial crisis. It lasted about seven months when QE2 was teased in August 2010 and was helped by the calming of the eurozone crisis after the first Greek bailout.

Now we're already in the third month of this new European variety of central bank largess.

Yet the economy faces a number of headwinds that are not going away: There are sovereign debt issues, fiscal austerity, rising trade protectionism, the debt-ceiling debate, the rise and fall and rise again of crude oil, a stalling of earnings growth, a whiff of inflation, moribund banks, a spate of elections, and mixed economic reports with sentiment high but job growth and housing still anemic.

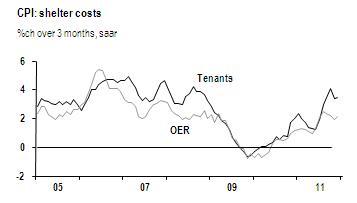

Until this dynamic changes, we're stuck in the mud. The Fed, or the ECB, might try to pull us out with lifelines of cheap cash -- but that is now just making the problem worse by fueling inflationary concerns. Just look at the rise in shelter costs due to a tight rental market, a major component of the Consumer Price Index.

Wall Street isn't looking that far ahead, I guess. But folks on Main Street, the ones who are watching at-the-pump prices rise again as those holiday bills come due, or are trying to find a nice rental home, already know what's coming. And it's not good.

No comments:

Post a Comment