Girl power in the boardroom:

India Inc's leading ladies

Roshni Nadar, Shiv Nadar's only daughter and a trained classical musician, is the executive director and CEO, HCL Corp. Before becoming CEO, she was the trustee of the Shiv Nadar Foundation.

Shobhana Bhartia is the chairperson and managing director of HT Media Ltd. She is the daughter of industrialist K.K. Birla and is married to Shyam Sunder Bhartia, chairman and managing director of Jubilant Life Sciences Ltd.

Aruna Jayanthi is the chief executive officer of Capgemini India, one of the biggest business units of Capgemini group. Jayanthi initially wanted a career in banking and finance, but joined TCS when the company made her a campus offer.

Preetha Reddy is the managing director of Apollo Hospitals. She joined the company in 1989 and became the managing director five years later.

Ekta Kapoor is the joint managing director of Balaji Telefilms, and is credited for having created two of the most popular soaps on Indian television.

Chanda Kochhar is the CEO and MD of ICICI Bank, India's largest private sector bank. She joined Industrial Credit and Investment Corporation of India Ltd in 1984 as a management trainee, and she took over her current post after K.V. Kamath, who was CEO of the bank since 1996, stepped down in May 2009

Nita Ambani is the chairperson of Reliance Foundation, and is married to Reliance Industries chairman Mukesh Ambani. She is a non-executive director on the board of Oberoi Hotels and Resorts.

Nita Ambani is the chairperson of Reliance Foundation, and is married to Reliance Industries chairman Mukesh Ambani. She is a non-executive director on the board of Oberoi Hotels and Resorts.

Kalpana Morparia is the CEO of JPMorgan India. Before joining JPMorgan, Morparia was the joint managing director at ICICI group from 2001 to 2007. She had been with the group since 1975.

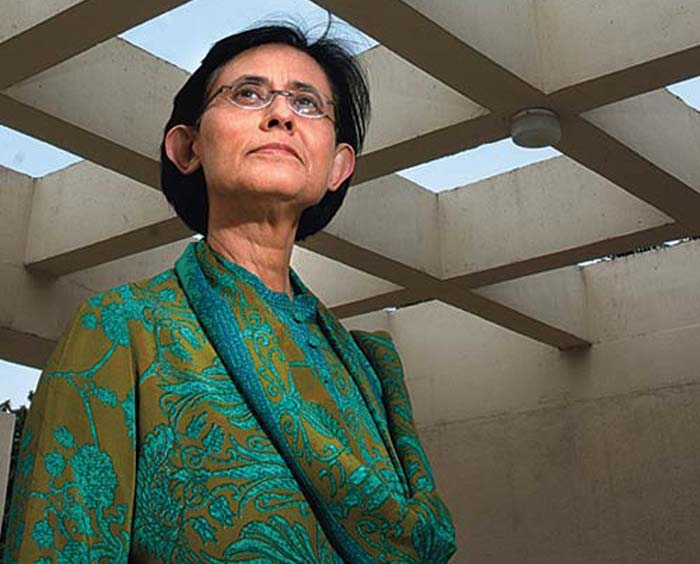

Zia Mody is the managing partner, AZB & Partners, the law firm that has advised companies such as Reliance Industries, Vedanta and Bharti Airtel on their biggest deals — BP, Cairn India and Zain, respectively.

Abanti Sankaranarayanan is the deputy managing director and marketing director at Diageo India. Before joining Diageo, she was executive director and deputy chief executive of Tata-owned Mount Everest Mineral Water.

Leena Nair (right) is executive director-human resources at Hindustan Unilever. Nair joined the company after passing out of XLRI and has stayed with it for 19 years. She took over her current role in June 2007.

Meher Pudumjee is the chairperson of Thermax, a position she took over after the retirement of her mother Anu Aga in October 2004. Pudumjee managed the company's subsidiary in the UK before joining the board of directors in 1996.

Schauna (left) and Nadia Chauhan Saluja are the CEO and director, respectively, at Parle Agro.

Vinita Bali is the managing director at Britannia Industries since May 2006. Bali's first job was at Voltas, after which she moved to Cadbury and then to Coca Cola. She joined Britannia as chief executive in January 2005.

Shikha Sharma has been the chief executive officer and managing director at Axis Bank since June 2009. Before joining Axis Bank, Sharma was the head of ICICI Prudential Life Insurance Co. She had started her career with ICICI Ltd in 1980.

Renu Sud Karnad has been the managing director of Housing Development Finance Corp. Ltd since January 2010. She had started her career in the legal and credit department of HDFC.

Anu Aga was the chairperson of Thermax from 1996 to 2004. She started her career in Thermax in 1985 and took charge of the company's human resources function form 1991 to 1996. She was nominated to the Rajya Sabha in April 2012.

Mallika Srinivasan is the chairman of Tractors and Farm Equipment, or TAFE. She has a graduate MBA from the Wharton School of Business, University of Pennsylvania, and an MA in Econometrics from the University of Madras. She is married to Venu Srinivasan, chairman and managing director of TVS Motor.

Kiran Mazumdar-Shaw, is the chairperson and managing director of Biocon, a company she started in 1978. She was awarded the Padma Shri (1989) and Padma Bhushan (2005) for her efforts in the field of biotechnology.

Naina Lal Lidwai is the country head of HSBC India, and was one of the first women to enter the investment banking business in the country.

http://www.ndtv.com/photos/business/girl-power-in-the-boardroom-india-inc-s-leading-ladies-14119/slide/20

In the Fortune list of top 10 most-paid businesswomen, Peninsula Land chairperson Urvi A. Piramal bagged the second rank with an annual pay package of Rs 7.3 crore.

In the Fortune list of top 10 most-paid businesswomen, Peninsula Land chairperson Urvi A. Piramal bagged the second rank with an annual pay package of Rs 7.3 crore. Apollo Hospital Enterprises managing director Preetha Reddy came third with an annual pay packet of Rs 6.9 crore.

Apollo Hospital Enterprises managing director Preetha Reddy came third with an annual pay packet of Rs 6.9 crore. Vinita Singhania, MD of JK Laksmi Cement, with a pay packet of Rs 5.9 crore, came next.

Vinita Singhania, MD of JK Laksmi Cement, with a pay packet of Rs 5.9 crore, came next. She was followed by Vinita Bali, MD, Britannia Industries, who took home Rs 5.7 crore.

She was followed by Vinita Bali, MD, Britannia Industries, who took home Rs 5.7 crore. HDFC managing director Renu Sud Karnad, with a pay package of Rs 5.1 crore, was next.

HDFC managing director Renu Sud Karnad, with a pay package of Rs 5.1 crore, was next.  ICICI Bank MD and CEO Chanda Kochhar, whose annual pay package is at Rs 4.24 crore, came eighth. Interestingly, Kochhar has been named as the most powerful woman in Indian business for the second consecutive year by Fortune.

ICICI Bank MD and CEO Chanda Kochhar, whose annual pay package is at Rs 4.24 crore, came eighth. Interestingly, Kochhar has been named as the most powerful woman in Indian business for the second consecutive year by Fortune.  After Kochhar, TAFE chairperson Mallika Srinivasan comes next in the most powerful women executive category.

After Kochhar, TAFE chairperson Mallika Srinivasan comes next in the most powerful women executive category. Capgemini India CEO Aruna Jayanthi stands third in the power list.

Capgemini India CEO Aruna Jayanthi stands third in the power list.