INDIAN MARKETS ARE SERIOUSLY UNWINDING THE LONG POSITIONS FOR WANT OF NEW TRIGGERS AND POLITICAL UNCERTAINTY ADDING. PREPARE FOR HDFC NEWS.

Friday, November 22, 2013

Saturday, November 16, 2013

Asset restructuring Rs 3.25 lakh crore-"out of control" ??????

Loan recast has gone 'out of control,' says RBI

PTI | Mumbai | Updated: Nov 16 2013, 16:44 ISTSUMMARY The overall asset restructuring in the banking system has touched Rs 3.25 lakh crore as of June.

Stating that the overall asset restructuring in the banking system has touched Rs 3.25 lakh crore as of June, RBI Executive Director B Mahapatra today said loan recast has gone "out of control" and all stakeholders need to tackle the problem jointly.

"Till March 2011, things were manageable. We had around Rs 1.1 lakh crore in recast loans, but now if you see, things are quite out of control. It has gone up to Rs 2.7 lakh crore. This is only CDR (corporate debt restructuring) and if you put both (CDR and bilateral restructuring cases between banks and companies) together, may be it might exceed Rs 3.25 lakh crore," he said at the annual Bancon here.

Mahapatra said the Reserve Bank of India was willing to "tolerate a bit of restructuring," but he exhorted banks to provide more against potential asset quality troubles and promoters to get more equity and personal guarantees.

"We'll tolerate a bit of restructuring, we will give the regulatory forbearance, offer more time – that is the loss or the sacrifice that we as regulators are willing to make. But you as bankers should also be willing to make more provisions... and the borrowers should also sacrifice, he should bring in more equity," he said."It is a loss-sharing arrangement. In a system, when there is a problem, all the stakeholders should share the loss," the executive director said.

Mahapatra pointed out that the RBI has increased the provisioning requirements for banks from 2 per cent earlier to up to 5 per cent in some cases.Seeking to allay concerns, Mahapatra said things are not as bad as they are made out to be. He said the total stress in the system, including non-performing assets (NPAs) and restructured assets, is under 10 per cent, which is less than the 16 per cent level in the aftermath of the 1997 Asian financial crisis.

The situation is not "panicky," he said.

http://www.financialexpress.com/news/loan-recast-has-gone-out-of-control-says-rbi/1195721

Friday, November 15, 2013

BAD LOANS RISINGS..NEGATIVE NEWS FLOWING..!!!!!

HOME

FE EDITOR'S PICKS

Loan restructurings fail to pull lenders out of misery, Rs 30,000 cr of loans likely to go bad very soon Aftab Ahmed, Vishwanath Nair SUMMARYA fifth of all loans that have been recast, via CDR cell could turn into non-performing assets.| Mumbai | Updated: Nov 15 2013, 08:37 IST

With the economy showing few signs of recovery, as much as Rs 30,000 crore of loans, currently classified as ‘standard’ because they’ve been restructured, could go bad very soon. Given corporates are under severe financial stress in a sluggish demand environment, bankers estimate that a fifth of all loans that have been recast, via the corporate debt restructuring (CDR) cell could turn into non-performing assets (NPAs). This would be higher than the 15% slippage seen from recast loans till last year.

If loans recast bilaterally — between banks and borrowers — are also considered, a little over a 10th could become NPAs. According to VR Iyer, chairman and managing director, Bank of India (BoI), “Of the total restructured amount, about 12% loans are slipping into bad loans.”

RK Goyal, executive director, Central Bank of India, said that since much of restructuring via the CDR cell has happened in the last three years, several borrowers are still enjoying a moratorium. “By next June, several corporates will need to start repaying debt and that’s when the slippages will really increase,” Goyal said.

With banks becoming stricter about offering borrowers more lenient terms — they’re insisting on personal guarantees from promoters and a 25% upfront equity from them — and with promoters not always able to fulfil these requirements, more accounts are turning bad. Indeed, a forensic audit of all cases referred to the CDR cell could soon become compulsory.

SBI chairperson Arundhati Bhhattacharya had on Wednesday observed there was likely to be more pain for the banking sector and had refrained from giving an outlook for the near term.

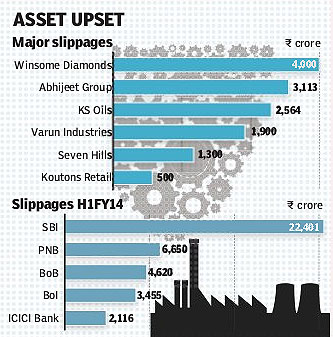

“We are not seeing indicators that say things are beginning to look brighter,” Bhattacharya had noted after the bank announced results for the September quarter. SBI has restructured close to Rs 13,000 crore in H1FY14 while total slippages – including those from non-recast accounts – were Rs 22,401 crore. For Punjab National Bank (PNB), slippages in H1FY14 were Rs 6,650 crore while for India's largest private sector bank ICICI Bank, they were smaller at Rs 2,116 crore.

Analysts point out the situation could deteriorate. Credit Suisse points out that restructuring was relatively low in Q2 as few large ticket restructurings were pushed to 3Q14 and that the restructuring pipeline is Rs 1500-4000 crore. So far in FY14, referrals to the CDR cell have hit Rs 80,000 crore and with signs of the economy recovering, bankers believe the quantum could easily cross Rs 1 lakh crore this year. Between April and September loans worth Rs 43,273 were recast. Meanwhile, the value of bilateral recasts could exceed that of loans restructured via the CDR cell.

Bank of Baroda saw slippages of Rs 4,620 crore in H1FY14 while the quantum for Punjab National Bank was Rs 6,650 crore. Bank of India’s H1FY14 slippages totalled Rs 3,455 crore. For banks like PNB, restructured loans and bad loans together account for over 10% of total assets while in case of banks like Allahabad Bank and Indian Overseas Bank, problem loans account for 15% and 13% of total loans, respectively. Among accounts referred to CDR and slipped in the in the first half of the year were Winsome Diamonds (Rs 4,000 crore), Abhijeet Corporate Group (Rs 3,113 crore), KS Oils (Rs 2,564 crore), SevenHills Hospitals (RS 1,300 crore) and Varun Industries (Rs 1,900 crore).

http://www.financialexpress.com/news/loan-restructurings-fail-to-pull-lenders-out-of-misery-rs-30000-cr-of-loans-likely-to-go-bad-very-soon/1195101/0

Thursday, November 14, 2013

TWEETS- @BNRSTOCKS

Tweets

- INDIAN MARKETS ARE POISED FOR NEW HIGHS, GOOD LONG TERM GROWTH STORY IS INTACT.ONE CAN EXPECT POSITIVE NEWS FLOW REGARDING BANKING SECTOR.

Subscribe to:

Posts (Atom)

Bammidi.NageswaraRao

Bammidi.NageswaraRao