INDIAN MARKETS ARE SERIOUSLY UNWINDING THE LONG POSITIONS FOR WANT OF NEW TRIGGERS AND POLITICAL UNCERTAINTY ADDING. PREPARE FOR HDFC NEWS.

Saturday, November 23, 2013

SEBI...SUPREME COURT...Sahara story..Rs 20,000 crore!!!!.

But where are the investors?

It raises a further question. If these are fictitious investors, who were a part of an elaborate money-laundering scheme, then, is SEBI — which is mandated to protect investors — the right organisation to be fighting this case? Should we be surprised that despite openly seeking out complainants, SEBI has made precious little headway? Wouldn’t it have been far better if the case was treated as a money-laundering one and left from the very beginning to the Enforcement Directorate? The ED, which has recently registered two cases on the issue, will investigate, among other things, whether the missing money has been transferred out of the country and whether a large number of the investors were phantoms — in effect, conduct the kind of probe that SEBI isn’t capable of.

The Supreme Court has put pressure on the group by preventing the sale of any of its properties and demanding that it submit original title deeds of land worth Rs 20,000 crore to SEBI. But the full truth of the Sahara story — the one about phantom investors and missing sums of money — is likely to be uncovered only by cases registered under the Prevention of Money Laundering Act (PMLA).

Nifty is headed towards 5,780-5,800...!!!

Nov 22, 2013, 06.08 PM IST Technicals:

Nifty will slide unless it can break past 6210

A look at the short-term price chart indicates that the Nifty is tracing out a bearish sequence of lower highs and lower lows. B Krishnakumar, fundsindia.com More about the Expert...Source: Moneycontrol.com

The Nifty has been struggling to get past its life-time high at 6,358. A look at the short-term price chart indicates that the Nifty is tracing out a bearish sequence of lower highs and lower lows. From the 15-minute chart featured below, it is evident that the index is moving within the confines of the blue set of lines. For 15-minutes chart, Click here The middle blue line is the key reference point and the trend remains bearish until the price moves past this centerline. The real level to contend with is the red balance line at 6,210.

As long as the Nifty trades below this red line at 6,210, the path of least resistance would be on the way down. As highlighted in the daily chart of the Nifty featured below, the open gap at 5,780-5,800 is the next destination. For daily chart, Click here A break below the recent low of 5,972 would indicate that the Nifty is headed towards this target at 5,780-5,800. Until there is a breakout above 6,210, there would be a strong case for a slide to 5,800.

Read more at: http://www.moneycontrol.com/news/market-cues/technicals-nifty-will-slide-unless-it-can-break-past-6210_995255.html?utm_source=ref_article

Friday, November 22, 2013

Cairn India to consider share buy-back next week....!!!!

Cairn India to consider share buy-back next week, move to help Vedanta Group

Reuters | New Delhi | Updated: Nov 22 2013, 13:50 ISTSUMMARYSteel billionaire Anil Agarwal-led Vedanta Group holds 58.76 per cent stake in Cairn India.Cairn India Ltd board will on Tuesday consider a proposal to buy back shares, a move which will help promoters Vedanta Group increase its stake in the company without putting any money.

Cairn, which is sitting on a cash pile of about USD 3 billion, in a filing to the stock exchanges said "a meeting of the Board of Directors of the company will be held on November 26, 2013, to consider the proposal for buy back of equity shares of the company."

Share buy back is the process where a company repurchases outstanding shares in order to reduce the number of shares on the market.Companies, as a rule, buy back shares either to increase the value of shares still available (reducing supply), or to eliminate any threats by shareholders who may be looking for a controlling stake.

As per SEBI rules, Cairn will buy a pre-decided quantity of shares from the market at a rate which is likely to be higher than current trading price. Such shares will be held as treasury stock and eventually extinguished.This will lead to its promoter Vedanta Group's stake in the company going up without putting any money.Steel billionaire Anil Agarwal-led Vedanta Group holds 58.76 per cent stake in Cairn India.

UK's Cairn Energy plc, which had sold majority stake in Cairn India to Vedanta Group, still holds 10.27 per cent shares and may look at the share buy back programme to exit.Vedanta Group had bought stake in Cairn India at Rs 355 per share, a price the company stock has not touched in last one year.

"Cairn Energy is a known seller for long time and the share buy back may present it with an opportunity to exit from Cairn India," an analyst said.While share buy back is considered an efficient means of returning capital to shareholders, it also indicates that the company is not looking at doing major acquisitions or has significant capex plans that may need its current cashpile. Analysts said Vedanta holds 112.27 crore shares out of a total of 191.05 crore outstanding shares of Cairn India.

Cairn UK Holdings Ltd has 19.61 crore shares while Life Insurance Corp (LIC) has 16.77 crore (8.78 per cent) shares.ICICI Prudential hold 1.08 per cent shares while foreign institutional investors (FIIs) have 15.14 per cent holding. Financial institutions and Bank have 8.7 per cent.

Analysts said in case Cairn India buys 10 per cent of 19.10 crore shares in the buy back programme and extinguishes them, the total outstanding shares will come down to 171.945 crore. The reduced outstanding shares would mean that Vedanta Group's stake would rise to about 65.3 per cent without it buying any new shares.

Cairn, which produces over 1,75,000 barrels per day of oil or a quarter of India's crude oil production, was up Rs 9.45 (2.98 per cent) at Rs 326.70 at 1300 hours on the BSE.

NIFTY LIKELY TO TOUCH 5800....!!!

Tweets

Surabhi Roy | Mumbai

November 22, 2013 Last Updated at 14:50 IST

'Nifty can test 5,880 levels in coming days'

Check out the trading strategies for Nifty, CNX IT, rate-sensitive segments with Mudit Goyal, technical analyst, SMC GlobalCheck out the trading strategies for Nifty, CNX IT, rate-sensitive segmentswith Mudit Goyal, technical analyst, SMC Global.

SmartInvestor: The markets have nudged higher today after witnessing a sharp downslide for the last two trading sessions. Do you see the trend continuing or should one use the upside to exit? What are the important levels one should keep a tab on?

Mudit Goyal: As per the charts, markets found difficulty to breach the level of 6210 levels which was the 61.8% Fibonacci retracement levels of recent downside from 6340 to 5970 levels. It corrected sharply and entered in its earlier support zone of 5980-6070 levels.

Mudit Goyal: Breakout of 6070 can attract some buying upto 6180 levels and on the downside, Nifty can test the level of 5880 in coming days. Yes, one should use the upside for reducing their positions.

SmartInvestor: What are your top three BUY recommendations from the Nifty pack?

http://www.business-standard.com/article/markets/nifty-can-test-5-880-levels-in-coming-days-113112200602_1.html

Saturday, November 16, 2013

Asset restructuring Rs 3.25 lakh crore-"out of control" ??????

Loan recast has gone 'out of control,' says RBI

PTI | Mumbai | Updated: Nov 16 2013, 16:44 ISTSUMMARY The overall asset restructuring in the banking system has touched Rs 3.25 lakh crore as of June.

Stating that the overall asset restructuring in the banking system has touched Rs 3.25 lakh crore as of June, RBI Executive Director B Mahapatra today said loan recast has gone "out of control" and all stakeholders need to tackle the problem jointly.

"Till March 2011, things were manageable. We had around Rs 1.1 lakh crore in recast loans, but now if you see, things are quite out of control. It has gone up to Rs 2.7 lakh crore. This is only CDR (corporate debt restructuring) and if you put both (CDR and bilateral restructuring cases between banks and companies) together, may be it might exceed Rs 3.25 lakh crore," he said at the annual Bancon here.

Mahapatra said the Reserve Bank of India was willing to "tolerate a bit of restructuring," but he exhorted banks to provide more against potential asset quality troubles and promoters to get more equity and personal guarantees.

"We'll tolerate a bit of restructuring, we will give the regulatory forbearance, offer more time – that is the loss or the sacrifice that we as regulators are willing to make. But you as bankers should also be willing to make more provisions... and the borrowers should also sacrifice, he should bring in more equity," he said."It is a loss-sharing arrangement. In a system, when there is a problem, all the stakeholders should share the loss," the executive director said.

Mahapatra pointed out that the RBI has increased the provisioning requirements for banks from 2 per cent earlier to up to 5 per cent in some cases.Seeking to allay concerns, Mahapatra said things are not as bad as they are made out to be. He said the total stress in the system, including non-performing assets (NPAs) and restructured assets, is under 10 per cent, which is less than the 16 per cent level in the aftermath of the 1997 Asian financial crisis.

The situation is not "panicky," he said.

http://www.financialexpress.com/news/loan-recast-has-gone-out-of-control-says-rbi/1195721

Friday, November 15, 2013

BAD LOANS RISINGS..NEGATIVE NEWS FLOWING..!!!!!

HOME

FE EDITOR'S PICKS

Loan restructurings fail to pull lenders out of misery, Rs 30,000 cr of loans likely to go bad very soon Aftab Ahmed, Vishwanath Nair SUMMARYA fifth of all loans that have been recast, via CDR cell could turn into non-performing assets.| Mumbai | Updated: Nov 15 2013, 08:37 IST

With the economy showing few signs of recovery, as much as Rs 30,000 crore of loans, currently classified as ‘standard’ because they’ve been restructured, could go bad very soon. Given corporates are under severe financial stress in a sluggish demand environment, bankers estimate that a fifth of all loans that have been recast, via the corporate debt restructuring (CDR) cell could turn into non-performing assets (NPAs). This would be higher than the 15% slippage seen from recast loans till last year.

If loans recast bilaterally — between banks and borrowers — are also considered, a little over a 10th could become NPAs. According to VR Iyer, chairman and managing director, Bank of India (BoI), “Of the total restructured amount, about 12% loans are slipping into bad loans.”

RK Goyal, executive director, Central Bank of India, said that since much of restructuring via the CDR cell has happened in the last three years, several borrowers are still enjoying a moratorium. “By next June, several corporates will need to start repaying debt and that’s when the slippages will really increase,” Goyal said.

With banks becoming stricter about offering borrowers more lenient terms — they’re insisting on personal guarantees from promoters and a 25% upfront equity from them — and with promoters not always able to fulfil these requirements, more accounts are turning bad. Indeed, a forensic audit of all cases referred to the CDR cell could soon become compulsory.

SBI chairperson Arundhati Bhhattacharya had on Wednesday observed there was likely to be more pain for the banking sector and had refrained from giving an outlook for the near term.

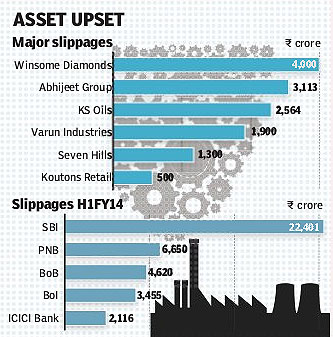

“We are not seeing indicators that say things are beginning to look brighter,” Bhattacharya had noted after the bank announced results for the September quarter. SBI has restructured close to Rs 13,000 crore in H1FY14 while total slippages – including those from non-recast accounts – were Rs 22,401 crore. For Punjab National Bank (PNB), slippages in H1FY14 were Rs 6,650 crore while for India's largest private sector bank ICICI Bank, they were smaller at Rs 2,116 crore.

Analysts point out the situation could deteriorate. Credit Suisse points out that restructuring was relatively low in Q2 as few large ticket restructurings were pushed to 3Q14 and that the restructuring pipeline is Rs 1500-4000 crore. So far in FY14, referrals to the CDR cell have hit Rs 80,000 crore and with signs of the economy recovering, bankers believe the quantum could easily cross Rs 1 lakh crore this year. Between April and September loans worth Rs 43,273 were recast. Meanwhile, the value of bilateral recasts could exceed that of loans restructured via the CDR cell.

Bank of Baroda saw slippages of Rs 4,620 crore in H1FY14 while the quantum for Punjab National Bank was Rs 6,650 crore. Bank of India’s H1FY14 slippages totalled Rs 3,455 crore. For banks like PNB, restructured loans and bad loans together account for over 10% of total assets while in case of banks like Allahabad Bank and Indian Overseas Bank, problem loans account for 15% and 13% of total loans, respectively. Among accounts referred to CDR and slipped in the in the first half of the year were Winsome Diamonds (Rs 4,000 crore), Abhijeet Corporate Group (Rs 3,113 crore), KS Oils (Rs 2,564 crore), SevenHills Hospitals (RS 1,300 crore) and Varun Industries (Rs 1,900 crore).

http://www.financialexpress.com/news/loan-restructurings-fail-to-pull-lenders-out-of-misery-rs-30000-cr-of-loans-likely-to-go-bad-very-soon/1195101/0

Thursday, November 14, 2013

TWEETS- @BNRSTOCKS

Tweets

- INDIAN MARKETS ARE POISED FOR NEW HIGHS, GOOD LONG TERM GROWTH STORY IS INTACT.ONE CAN EXPECT POSITIVE NEWS FLOW REGARDING BANKING SECTOR.

Subscribe to:

Posts (Atom)

Bammidi.NageswaraRao

Bammidi.NageswaraRao